Contact us: +44(0) 203 443 9815 info@tradephlo.com

Why choose tradePhlo?

Goods Classification

Utilize descriptive input to accurately classify goods, significantly reducing the risk of errors.

Integrated Duty Calculation

Automatically calculate duties and taxes, apply for reliefs, and understand country-specific controls without leaving the platform.

.webp)

Provisional Calculations

Make use of provisional calculations to test scenarios before committing to final submissions.

.webp)

Descriptive Input Method

Simplify the classification process with a user-friendly input method that guides you to the correct commodity code.

Continuous Regulatory Updates

Rely on a platform that adapts to changes in trade regulations and tariff codes, ensuring ongoing compliance.

Key Benefits

Accuracy in Classification

Reduce the risk of errors and potential penalties with our in-built goods classification system.

Financial Efficiency

Identify duty relief opportunities and ensure you are paying the correct amount of taxes and duties.

Regulatory Compliance

Stay ahead of country-specific import controls and regulations with our continuously updated database.

Operational Streamlining

Save time and resources by simplifying the classification and tariff calculation processes.

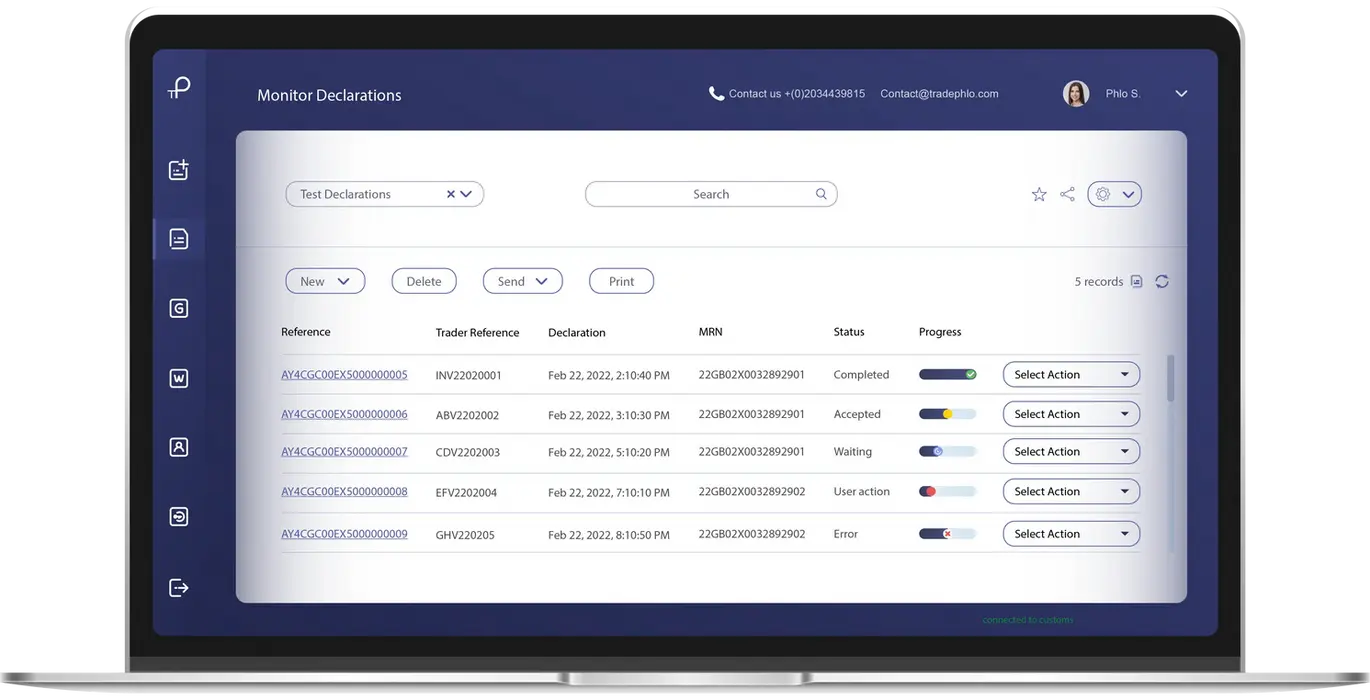

How It Works

01

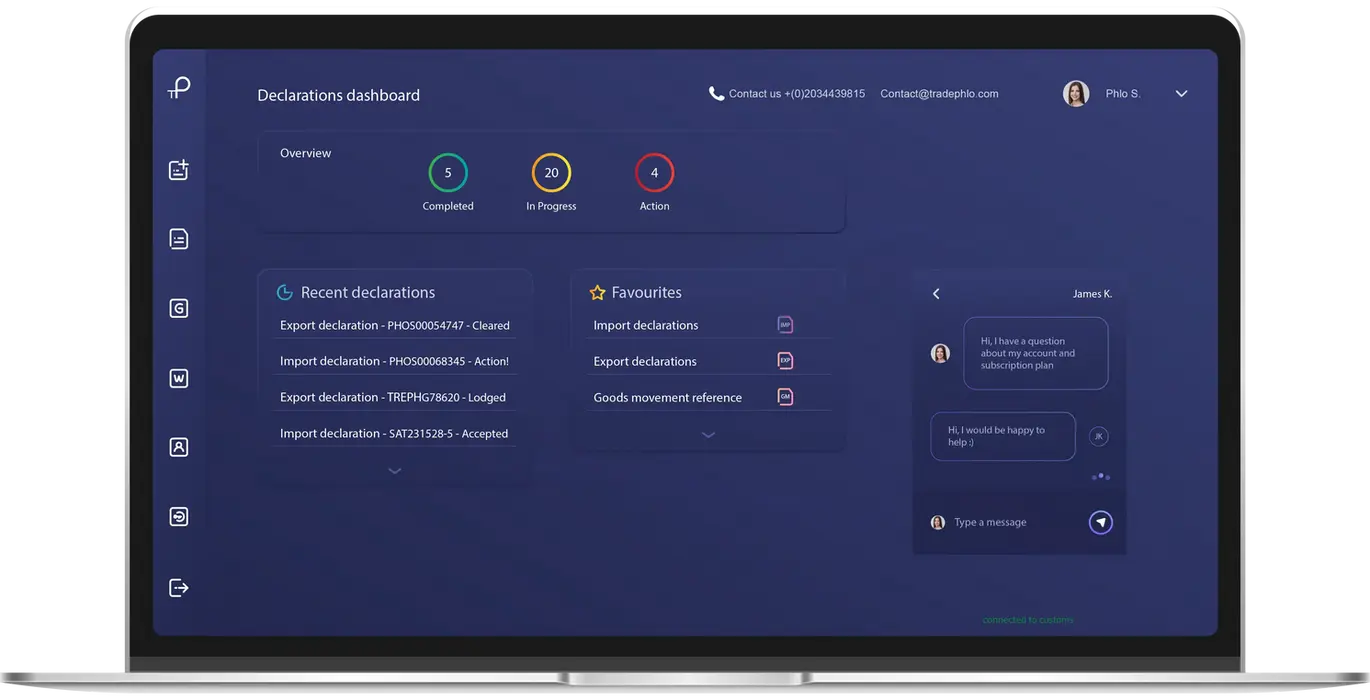

Effortless Onboarding

Set up your tradePhlo account to start your customs declarations module with goods classification and integrated trade tariff solutions.

02

Automated Classification

Input a description of your goods and find the correct commodity code within the system.

03

Tariff Calculations

Access detailed duty and tax calculations, including relief opportunities and country-specific controls, directly through our platform.

04

Review and Adjust

Utilize our provisional calculations to make any necessary adjustments before finalizing your classification and tariff entries.

05

Continuous Learning

Benefit from a system that evolves with regulatory changes, ensuring your operations remain compliant and up to date.

What our customers have to say:

Jaslyn Enterprise

E-commerce business | 5000+ products, over 40 categories

Frequently Asked Questions

A

Yes, tradePhlo supports declarations for a broad spectrum of goods, including restricted and controlled items, ensuring compliance with necessary regulations.

Q

Can tradePhlo handle customs declarations for all types of goods, including restricted or controlled items?

A

Our platform is regularly updated to mirror the latest in customs regulations and tariffs, backed by a dedicated team of experts monitoring global changes including HMRC updates.

Q

How does tradePhlo stay updated with customs changes?

A

Yes, tradePhlo offers seamless integration with various logistics and ERP systems, enhancing data flow and minimizing manual entry errors.

Q

Can tradePhlo integrate with other systems?

A

Absolutely. tradePhlo offers resources and support to guide new users through the classification process, ensuring you feel confident and informed at every step.

Q

Is there support available for new users unfamiliar with goods classification?

A

Our platform is continuously updated to reflect the latest in trade regulations and tariff codes, ensuring your classifications and calculations remain compliant.

Q

What happens if there are changes in tariff codes or regulations?

"AI-powered Customs and VAT Fraud Detection." Gain valuable intel on ChatGPT and the latest in commercial modal trends. Watch the full recording now!

"AI-powered Customs and VAT Fraud Detection." Gain valuable intel on ChatGPT and the latest in commercial modal trends. Watch the full recording now!

[Webinar] AI-powered Customs and VAT Fraud Detection. Delve into VAT fraud insights and navigate the complex trade regulation landscape. Gain valuable insights now!

Why should you consider migrating to tradePhlo customs software?

Why should you consider migrating to tradePhlo customs software?

Migrating to TradePhlo simplifies customs management by consolidating functions into a single platform, enhancing efficiency through automation, and ensuring real-time compliance with changing regulations.

Simplifying Customs Clearance for Removal Companies

Simplifying Customs Clearance for Removal Companies

With tradePhlo, removal companies can navigate customs clearance with confidence, ensuring efficiency, compliance, and cost-effectiveness. Let us handle the complexities so you can focus on what you do best – providing exceptional removal services.